This is a complex subject—first, some introductory concepts. Then, the details.

- In healthcare, the intersection of demand, price, quality, and suppliers’ sources alone does not determine whether pricing is appropriate.[i] Medical necessity, a complex method of determining whether a product or service should be used, is also a factor. Medical necessity is used by payors, including private insurance, Medicare, and Medicaid, to determine whether a medical procedure should be provided at all. (See Drug Pricing Legislation and Inefficient Markets Theory – No World Borders)

- Over ten different classification systems categorize II. Drugs, however, the National Drug Code (NDC) (see National Drug Code Directory), the Generic Product Identifier (GPI) (see Medi-Span® Generic Product Identifier (GPI)), and RxNorm used extensively for electronic prescribing are essential standards. (See http://noworldborders.com/2018/03/01/drug-pricing-classification-systems/), (see also RxNorm Overview)

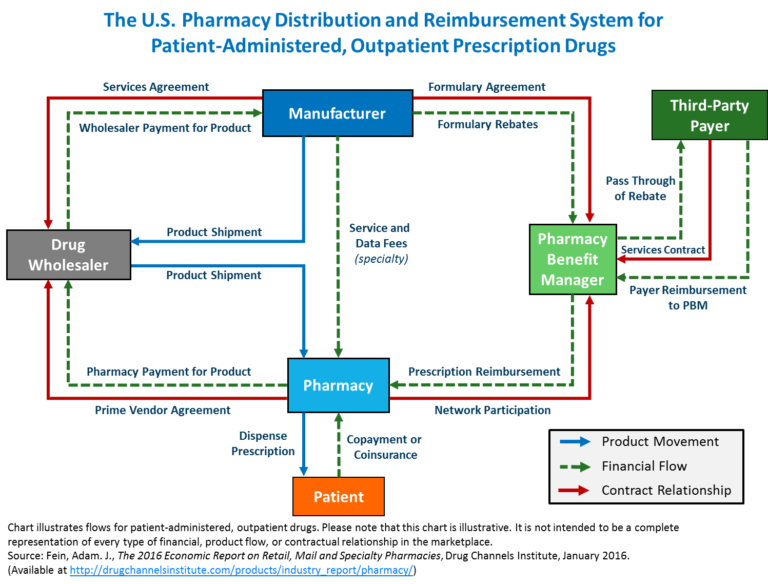

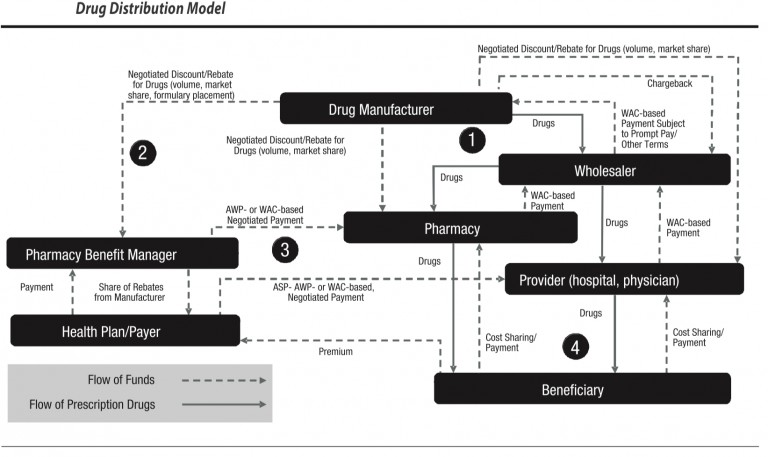

There are three concepts that are important to understand in pharmaceutical/drug pricing. The first is the flow of physical drugs. The second is the flow of funds. The third is eligibility determination for coverage of drug costs by insurance.

- From a flow of drugs perspective, the drug manufacturer provides products to a wholesaler. Wholesalers sell to a pharmacy, physician, hospital, or clinic, who can sell/fulfill drugs to an insured beneficiary with a prescription from a physician or other provider such as a hospital. (See diagram from Academy of Managed Care Pharmacy).

- From a flow of funds perspective, Drug Manufacturers receive funds from a Wholesaler at a Weighted Average Cost or (WAC) payment subject to prompt payment and other terms. The Drug manufacturers can issue chargebacks based on inventory/stock balancing and other factors. The manufacturer may also charge a provider at a negotiated discount rebate for drugs based on volume and market share. Providers and physicians issue WAC-based payments back to wholesalers. Beneficiaries issue cost-sharing payments to providers. Health plans (payer aka insurance) issue payments at Average Selling Price, or Average Wholesale Price (AWP) or Was negotiated payments to providers as reimbursement. Beneficiaries issue payments to the health plan in the form of premiums. This flow was established decades ago.

- From an eligibility perspective, private insurance insureds, Medicare Part D insureds, and insureds from Medicaid (state insurance funded in part by the Federal government and distributed by states, which has different names in different states) must be deemed eligible for coverage of drug costs. Eligibility is determined based on a combination of factors. These include the diagnosis or condition of the patient and whether the drug is indicated for the patient’s diagnosis or condition. Second, the health insurance coverage plan design and formulary. A drug (whether brand name or generic) may be listed on a formulary that is identified in the health insurance plan. Third, the usual customary and reasonable price of the drug from the supplier, and fourth, whether the supplier is a contracted provider to the health plan. If not, the drug may be supplied and partially reimbursed as an out-of-network reimbursement. These issues are complex, and over time health plans have begun to contract with an outside or partly owned entity to manage this process.

Enter the Pharmacy Benefit Manager (PBM), which receives payments from health plans, and a share of rebates from manufacturers are issued back to the health plan. The Drug manufacturers issue negotiated discounts and rebates for drugs based on volume, market share, formulary placement). PBMs issue contracts to health plans, generally pricing their coverage for drugs at WAC. WAC can be used correctly, or it can be manipulated, based, for example, on last in first out (LIFO) or first in first out (FIFO) pricing. The purchase/payment lots can vary from a small volume of drugs at a high price point or the same drug purchased in a high volume at a lower price point. If PBMs contract for a LIFO-based WAC, they can buy in high volume at a low price to decrease the price point, then purchase a small amount at a high price and charge based on LIFO. This can yield artificially high profits. This is not to say that all PBMs operate in this manner. Still, the use of analytics combined with detailed knowledge of drug classification taxonomies is essential to determine if contractual arrangements are being met. Unfortunately, there is no simple answer on price determinations because PBMs use several factors in their negotiations. Here are just a few.

PBMs negotiate several provisions in contracts, including Formulary selection, Dispensing fees and discounts, Utilization management, Mail order discounts, Administrative charges, Discounts or rebate guarantees, Price protection which can affect Medicare bids and inflationary increases, Membership driven discounts to plans with more members, Rebate maximization in Medicare Part D coverage in lieu of discounts, Multi-year agreements, Tiered and select pharmacy network, Limiting days’ supply, Prior authorization, Biosimilars, and Specialty pharmacy contract provisions.

Related topics

Drug Pricing and efficient markets theory

About Michael F. Arrigo

Michael F. Arrigo is a founder of No World Borders. The company’s first client was Advanced Medical Optics, later acquired and renamed Abbott Medical Optics, which is now part of Johnson & Johnson. Arrigo and his team led the implementation of a solution for the medical device and pharmaceutical divisions; a pharmacovigilance complaint handling system which was implemented to comply with FDA Adverse Event Reporting requirements such as Corrective Action, Preventative Action or CAPA as provided for in 21 CFR 820.90 nonconforming product; 21 CFR 829.100 Corrective Action, Preventative Action; 21 CFR 820.198 complaint files.

[i] Pharmacy Benefit Managers Drug Pricing – No World Borders …. https://noworldborders.com/2020/06/01/pharmacy-benefit-managers-drug-pricing/