Pharmacy Benefit Manager Expert Witness

A Pharmacy Benefit Managers expert witness (also known as PBM expert witness) must comprehend that Drug Prices are complex. First, I’m introducing some introductory concepts. Then will provide citations to details. Pharmacy Benefit Managers (PBMs) evolved over a few decades in the drug prices business and intersect the flow of physical drugs, the flow of funds, and medical necessity determinations for health plans.

DISCLAIMER

Under the current rebate-based system, beneficiaries may or may not receive the benefits of reduced prices and costs that other parties do. The devil is in the detail of the pricing contracts and actual drugs, the charges, and rebates. Analytics of actual claim data using NCPDP, RxNorm, or NDC codes (see Drug Pricing Expert and Drug Classification Systems) is required to perform real-life analysis. In some cases, parties to prescription drug sales are paid based on a percentage of the WAC, and therefore, as list price increases, so do the revenue to these parties.

Depending on the analysis, in the context of branded prescription drugs, the net revenue to the PBM and manufacturer generally may increase as the WAC increases. (See Perverse Market Incentives Encourage High Prescription Drug Prices. Garthwaite and Scott Morton. Pro-Market: The blog of the Stigler Center at the University of Chicago Booth School of Business. November 1, 2017.)

PBM Basics

- In healthcare, the intersection of demand, price, quality, and sources of suppliers alone does not determine whether pricing is appropriate. Medical necessity, a complex method of determining whether a product or service should be used is also a factor. Medical necessity is used by payors, including private insurance, Medicare, and Medicaid to determine whether a medical procedure should be provided at all. (See Drug Pricing Legislation and Inefficient Markets Theory – No World Borders)

- Drugs are categorized by over 10 different classification systems, however the National Drug Code (NDC) (see National Drug Code Directory), the Generic Product Identifier (GPI) (see Medi-Span® Generic Product Identifier (GPI)), and RxNorm used extensively for electronic prescribing are important standards. (See http://noworldborders.com/2018/0…), (see also RxNorm Overview) Pharmacy benefit managers use one of these standards. See other posts on this web site.

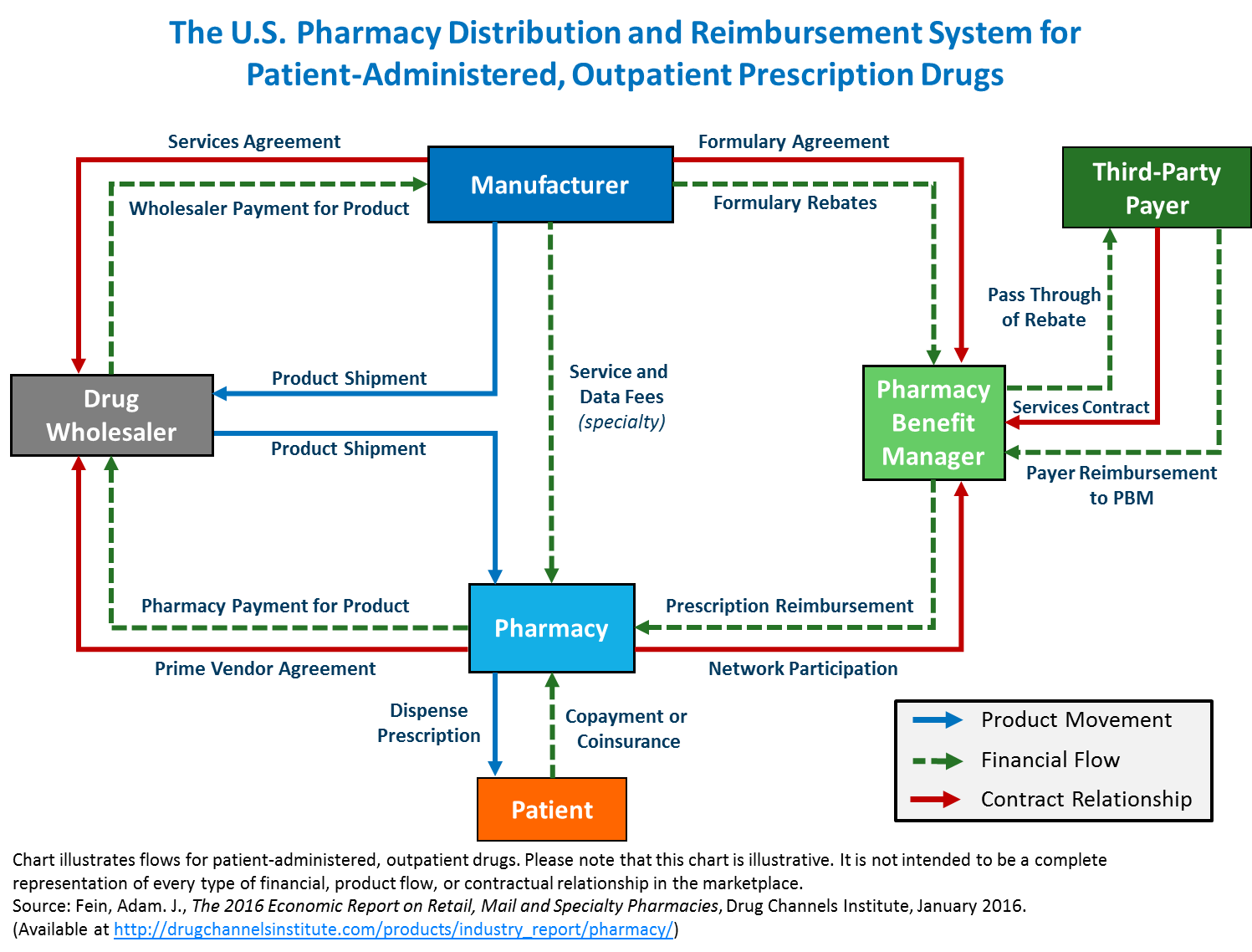

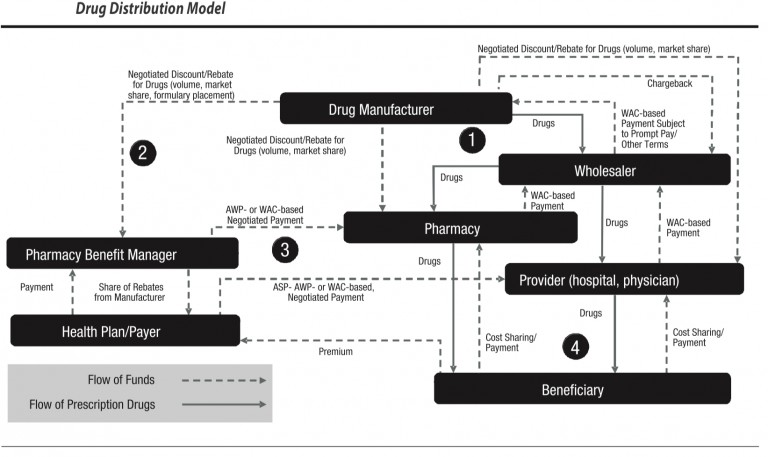

- There are three concepts that are important to understand in pharmaceutical/drug pricing. The first is the flow of physical drugs. The second is the flow of funds. the third is eligibility determination for coverage of drug costs by insurance. Pharmacy Benefit Managers are central in this process in many cases.

- PBMs collect payments from health plans and receive a share of rebates from manufacturers that are issued back to the health plan. PMBs manage a complex task in the drug supply and beneficiary reimbursement segment of health care. Drug prices are set by a complex set of methods, contractual understandings as well as market customary charges and reimbursement.

- Therefore, Pharmacy Benefit Manager experts must understand the flow of funds. The Drug manufacturers issue negotiated discounts and rebates for drugs based on volume, market share, formulary placement). PBMs issue contracts to health plans, generally pricing their coverage for drugs at WAC. WAC can be used correctly or it can be manipulated, based for example on last in first out (LIFO) or first in first out (FIFO) pricing. The purchase/payment lots can vary from a small volume of drugs at a high price point or the same drug purchased in high volume at a lower price point. If Pharmacy Benefit Managers contract for a LIFO based WAC they can purchase in high volume at a low price to decrease the price point, then purchase a small amount at a high price and charge based on LIFO. This can yield artificially high profits. This is not to say that all PBMs operate in this manner, but the use of analytics combined with detailed knowledge of drug classification taxonomies is essential to determine if contractual arrangements are being met. Pharmacy Benefit Managers are integral to this process and can be audited using complete NDC codes.

(For more information see my recent answer that discusses drug pricing and pharmacy benefit managers (PBMs) on Quora at https://www.quora.com/How-do-pharmacy-benefit-managers-determine-drug-pricing/answer/Michael-Arrigo-1)

Determining the Benefit in Pharmacy Benefit Managers

The Federal government and state governments are scrutinizing pharmacy benefit managers — the go-betweens in the prescription drug supply chain — in their efforts to bring down the cost of prescription drugs. According to the Pew Charitable Trust, PBMs administer drug plans for more than 266 million Americans.

Some question the actual patient benefit from the rebates that PBMs secure from drugmakers. PBMs insist that they share financial gains with health plans. The companies’ national advocacy group estimates that their bargaining prowess will save health plans and consumers $654 billion between 2016 and 2025 (see PCMA findings, below).

In January 2019, the U.S. Department of Health and Human Services proposed a new federal requirement that PBMs pass on to consumers any discounts they receive from drugmakers. The “Removal of Safe Harbor Protection for Rebates Involving Prescription Pharmaceuticals and Creation of New Safe Harbor Protection for Certain Point-of-Sale Reductions in Price on Prescription Pharmaceuticals and Certain Pharmacy Benefit Manager Service Fees” is posted for public comment has until April 8th, 2019. Update: Later in 2019 the Trump administration withdrew its proposed rule to block rebates.

Among the findings by the Pharmaceutical Care Management Association (PCMA):

PBM tools focus on six primary areas to produce savings:

-

- Negotiating rebates from drug manufacturers

- Negotiating discounts from drugstores

- Offering more affordable pharmacy channels

- Encouraging the use of generics and affordable brands

- Reducing waste and improving adherence

- Managing high-cost specialty medications

PCMA asserts that PBMs will Lower Drug Benefit Costs by $654 Billion over the Next Decade

From 2016 to 2025, the use of PBM tools will save employers, unions, government programs, and consumers $654 billion—or up to 30%—compared with programs that make little use of proven PBM tools. The breakdown in total savings includes:

-

- Commercial plan sponsors and their members will save nearly $350 billion;

- Medicare Part D and its beneficiaries will save nearly $257 billion; and

- Managed Medicaid plans will save nearly $48 billion.

PBMs and How they Impact Point of Sale Retail Pharmacy Drug Costs

The following is one example of a name-brand prescription drug dispensed to an insured beneficiary at a retail pharmacy. In this example, the drug has a Wholesale Acquisition Cost (also known as ‘WAC’) with a list price of $100. A drug manufacturer sells the drug to a pharmaceutical wholesaler at a two percent (2%) discount from WAC. Therefore, the drug is sold to a wholesaler at $98. Then, the wholesaler sells the drug to a pharmacy for $100. A PBM negotiates on behalf of a plan for reimbursement from the pharmacy that dispenses the drug and a rebate from the manufacturer for listing the drug on the PBM plan’s formulary. In its contract with the PBM, the pharmacy is paid a negotiated rate for example (1.20 × WAC) – (15 %) plus a $2 dispensing fee.

The pharmacy files a claim on behalf of the patient to the patient’s insurance. This claim is processed by the plan or the PBM on the plan’s behalf. The PBM determines the amount that it will pay the pharmacy, and the amount remaining for the patient to pay the pharmacy. In this example, the pharmacy is paid $104 for the drug. After the transaction, the plan or PBM may also receive rebates from the manufacturer, and possibly, pay the pharmacy less than the original amount.

In this example, the PBM negotiated a rebate with a manufacturer of thirty percent (30%) percent of the WAC ($30), which is passed on to the plan sponsor. Therefore, in this example, the plan receives $30 in rebates, reducing its cost for the drug to $74 ($104-$30). The rebate does not reduce the price charged at the pharmacy counter or the beneficiary’s out-of-pocket cost, and the beneficiary’s $26 coinsurance is actually 35 percent of the net cost of the drug ($104-$30), compared to the 25 percent coinsurance described in the benefits summary (which is based on negotiated pharmacy reimbursement and not net price.

PBM and Rebate Example

| Transaction | Value | Assigned Alphabetic Label of Transaction, Explanation or Formula to Calculate Value |

|---|---|---|

| List Price | 100 | (A). |

| Pharmacy Reimbursement | 104 | (P). |

| Rebates to Health Insurer | -30 | (B) = 30% Rebate from Manufacturer * (A). |

| Net Drug Cost | 74 | (C) = (P)−(B). |

| Patient Coinsurance | -26 | (D) = 25% * (P). |

| Net Cost to Health Insurer | 48 | (E) = (C)−(D). |

| Patient Coinsurance | 26 | (D) |

| Gross Drug Cost | 104 | (P). |

| Net Drug Cost | 74 | (C). |

| Share of Gross Cost | 0.25 | (H) = (P)/(A). |

| Share of Net Cost | 0.35 | (I) = (D)/(C). |

The Trump Administration’s Rule (Proposed January 2019, withdrawn July 2019)

The rule was proposed by the Office of Inspector General of the Department of Health and Human Services (HHS) on January 31, 2019. According to the Congressional Budget Office, it would eliminate the existing safe harbor for rebates paid by pharmaceutical manufacturers to health plans and PBMs in Medicare Part D and Medicaid managed care beginning January 1, 2020. (That safe harbor protects those parties from liability or penalty in specific situations defined in regulations implementing the anti-kickback statute, which prohibits offering or accepting payments to induce use of services reimbursable under federal health care programs.) That change would effectively make it illegal for a drug manufacturer to pay rebates to a health plan or PBM in those programs in return for coverage or preferred treatment of the manufacturer’s drug under the PBM’s plan. The rule would replace that safe harbor with two new ones: one related to upfront discounts for prescription drugs and the other to service fees.

Related Posts

Medicare Part D Expert Witness

Drug Pricing Expert Witness Methodology

Drug Pricing Expert and Drug Classification

Drug Pricing and Efficient Markets Theory