Buy insurance by Sunday, January 31, 2016 which is the last day to buy health insurance to avoid a $695 per adult and $347.50 per child penalty, or 2.5% of annual household income whichever is higher. The only way to avoid the penalty is to have insurance that qualifies as Minimum Essential Coverage, qualify for a life event authorized by the U.S. department of Health and Human Services, or become a member of a faith based healthcare cost sharing ministry. (Faith based health care cost sharing satisfies the Federal health care law’s (Affordable Care Act) requirement that individuals purchase insurance or pay a penalty-tax (see 26 United States Code Section 5000A, (d) (2) (B)).).

Exemptions from the Affordable Care Act to Avoid a Penalty

There are certain situations that enable a U.S. citizen to avoid the penalty mandated by the Affordable Care Act.

- If you qualify for post January 31 2016 Special Enrollment Period for people who qualify based on certain Life Events.

- If you join a faith based healthcare cost sharing ministry that shares medical expenses instead of buying traditional insurance. Ministry groups that obtained an exception to the Affordable Care Act law enable members some shelter not only from high medical costs but from penalties. Only ministries in continuous operation since at least Dec. 31, 1999 are exempt from the ACA. The carve-out was intended to satisfy what at the time were relatively small religious groups that argued that their non participation was a matter of religious freedom. Check reviews and coverage details because these groups are not insurance and may have some risks. Examples of ministries include:

- Detroit MI based Christ Medicus

- Peoria, Il based Samaritan Ministries

- If you are eligible for insurance that qualifies as Minimum Essential Coverage.

Minimum Essential Coverage (MEC)

Any insurance that meets the Affordable Care Act requirement for having health coverage. If you have MEC, you don’t have to pay the fee for being uninsured (See Healthcare.gov, Minimum Essential Coverage). Examples include:

- Any health plan bought through the Health Insurance Marketplace

- Individual health plans bought outside the Health Insurance Marketplace, if they meet the standards for qualified health plans

- Any “grandfathered” individual insurance plan you’ve had since March 23, 2010 or earlier

- Any job-based plan, including retiree plans and COBRA coverage

- Medicare Part A or Part C (but Part B coverage by itself doesn’t qualify)

- Most Medicaid coverage, except for limited coverage plans

- The Children’s Health Insurance Program (CHIP)

- Coverage under a parent’s plan

- Most student health plans (check with your school to see if the plan counts as minimum essential coverage)

- Health coverage for Peace Corps volunteers

- Certain types of veterans health coverage through the Department of Veterans Affairs

- Most TRICARE plans

- Department of Defense Nonappropriated Fund Health Benefits Program

- Refugee Medical Assistance

- State high-risk pools for plan or policy years that started on or before December 31, 2014 (check with your high-risk pool plan to see if it qualifies as minimum essential coverage)

Sources:

Calculating Your Obamacare Penalty

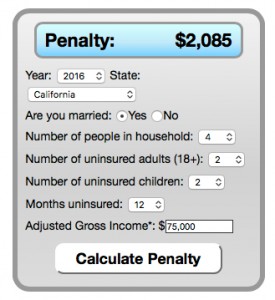

In 2016, a family of four with $75,000 in household income with two adults and two children at home may owe a penalty of over $2,000 if they choose not to secure health insurance.

Source:

Related Posts

- Employer insurance reporting mandate for 2016 extended by IRS

- Affordable Care Act Expert Witness Work Requires Attorney Education

- http://noworldborders.com/expert-witness/affordable-care-act-expert-witness/

- http://noworldborders.com/2016/02/09/expert-witness-for-medical-billing-and-coding/