A Medicare Part D Expert Witness should understand the differences between how Medicare Part A, Medicare Part B, Medicare Part C, and Medicare Part C are administered.

Finding a Medicare Part D expert witness requires specific criteria. Specialized Knowledge of a Medicare Part D expert witness entails several components.

Overview of Medicare Part D, Medicare Part C

- Medicare Part D a type of insurance offered by the Federal government that provides prescription drug insurance to eligible Medicare beneficiaries. Part D is only provided through private insurance companies that have contracts with the government. If an eligible Medicare insured has traditional Medicare and wants Part D coverage, the beneficiary must purchase it separately.

- Medicare Part C is a different method of acquiring Medicare Part A and Medicare Part B coverage. Part C is administered by private health insurance companies. The private health plans are known as Medicare Advantage (“M.A.”) plans. A Medicare Part D expert witness should understand how M.A. plans function.

- M.A. plans always combine Medicare Part A and Medicare Part B. They may also integrate Medicare Part D into one plan with Medicare Part A and Medicare Part B.

Even though private insurance companies administer Medicare Part C and Medicare Part D plans, they are regulated by the Federal Government. These entities have a duty to ensure the accuracy of the information they collect from Medicare Part C and Medicare Part D medical providers (such as patient documentation, diagnosis information, and medicare procedures billed ) to ensure the accuracy of subsequent distribution of Federal funds to those providers or insured beneficiaries.

A Medicare Part D expert witness should understand that 42 CFR §422.562(a)(4) and 423.562(a)(5) requires that all M.A. and Part D plans have a medical director on staff who ensures the clinical accuracy of all coverage decisions made by the plan that involves determinations of medical necessity. (See 10.4.2 – Role of the Medical Director at https://www.cms.gov/Medicare/Appeals-and-Grievances/MMCAG/Downloads/Parts-C-and-D-Enrollee-Grievances-Organization-Coverage-Determinations-and-Appeals-Guidance.pdf )

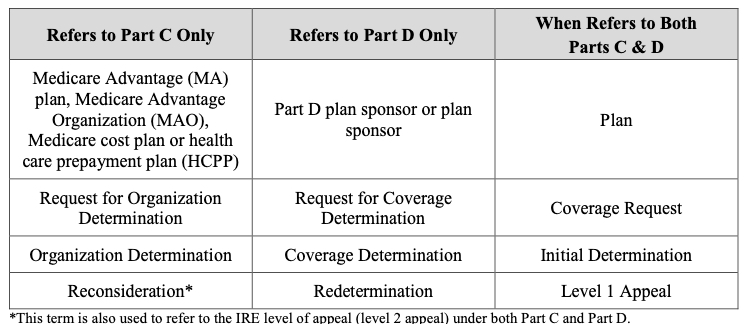

A Medicare Expert Witness should understand the appeals, grievances, and reconsideration processes. Below is a summary of common terminology:

History of Medicare and Medicare Part D

Medicare Part D expert witnesses should have a historical context.

Before 2006, Medicare paid for some drugs administered during hospital admission (under Medicare Part A), or a doctor’s office (under Medicare Part B). Generally, Medicare covers 100% of inpatient hospital stays (Part A), and 80% of the allowed amount for Part B, associated with non-hospital or outpatient care.

Until January 1, 2006, Medicare did not cover prescription drugs. Congress legislated Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also known as “MMA.” The implementation of MMA gave rise to the Medicare Part D program, sometimes also called “Medicare Rx.”

Generally. Medicare Part D Covers those Drugs as Defined in Title XVIII of the Social Security Act

Medicare Part D drugs are defined in Title XVIII of the Social Security Act (the Act). They are also defined in 42 CFR §423.100. Medicare Part D sponsors are responsible for making appropriate and accurate coverage determinations. They must also ensure that covered Medicare Part D drugs meet the requirements (see below).

Medicare Part D expert witnesses need to comprehend various definitions for covered Medicare Part D drugs.

“Subject to the exclusions …” “A Part D drug means the following if used for a medically accepted indication as defined by section 1927(k)(6) of the Act:

- A drug that may be dispensed only upon a prescription that is described in sections 1927(k)(2)(A)(i) through (iii) of the Act;

- A biological product described in sections 1927(k)(2)(B)(i) through (iii) of the Act;

- Insulin described in section 1927(k)(2)(C) of the Act;

- Medical supplies associated with the delivery of insulin;

- A vaccine licensed under section 351 of the Public Health Service Act and its administration. “

See the Medicare Part D Benefits Manual at https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovContra/Downloads/Part-D-Benefits-Manual-Chapter-6.pdf

This Standard is based on Revision 18, issued, effective, and implementation required on January 15, 2016.

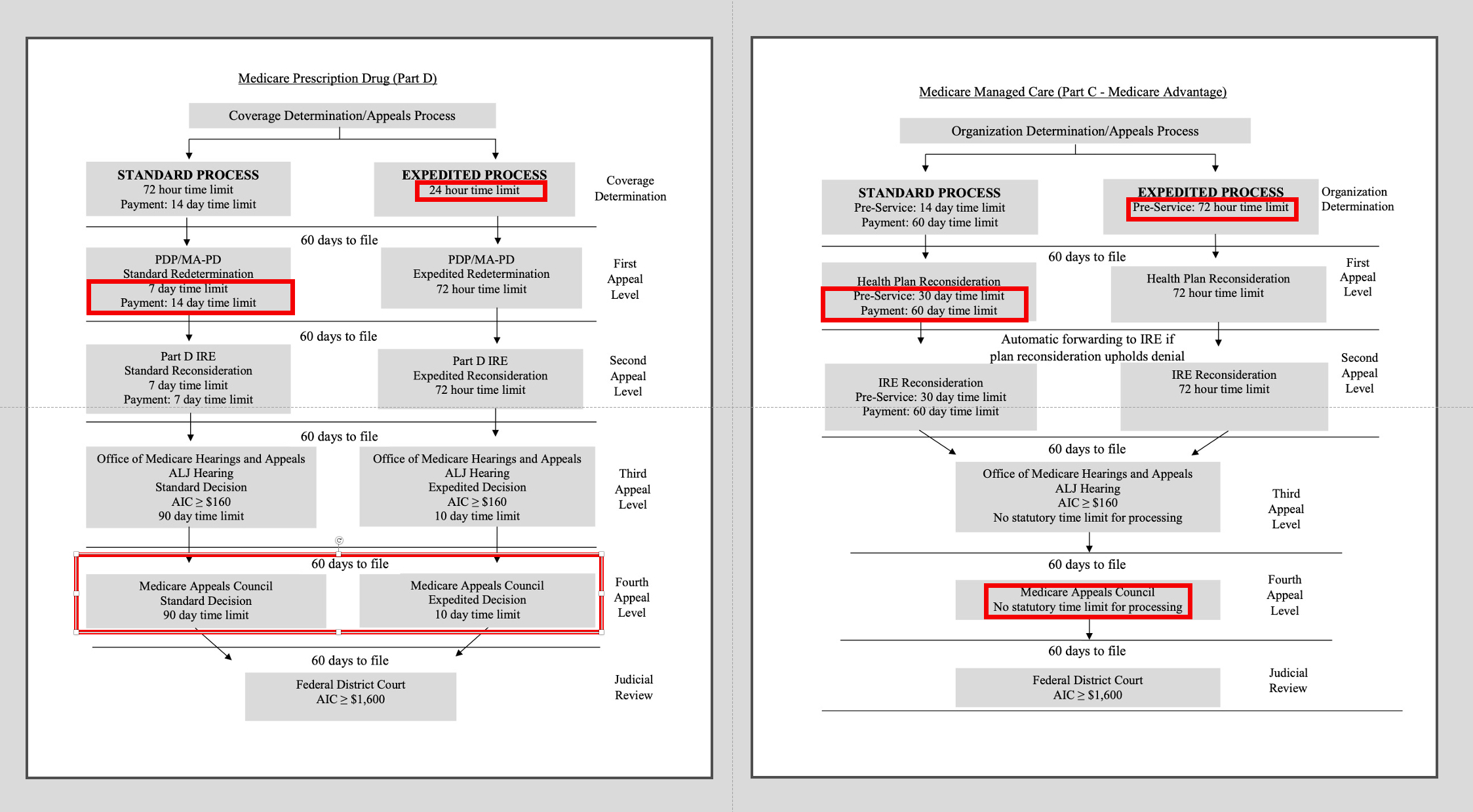

Appeals Process Medicare Part D Medicare Part CHow Medicare Part C and Part D are Administered

The Centers for Medicare and Medicaid (CMS) directly administer Medicare Parts A and B. Medicare Part C, and Part D administration is accomplished by CMS contracts with private companies. Generally, these companies are insurance businesses that are authorized to sell Part C and Part D insurance coverage. The companies are regulated and subsidized by Medicare, and Part C and Part D plans have a fiduciary duty to maintain the accuracy of the information they collect to ensure accurate disbursement of Federal funds to Medicare insureds. Generally, contracts with private insurance companies are one-year, annually renewable agreements.

How one Becomes a Medicare Part C or Part D Covered Beneficiary

To obtain Medicare Part D coverage, beneficiaries must purchase a Part C policy that includes Part D, or directly enrol in a Part D policy.

The costs associated with Medicare Parts C and D include monthly premiums, and, when there are insurance claims submitted for prescription drugs there is an annual deductible. The deductible may at times, be waived by Part C or Part D plans. There are also co-payments, and coinsurance for specific drugs, and catastrophic coverage once a threshold amount has been met.

Special Provisions for Low-Income and Disabled Citizens of the U.S.

Qualified low-income beneficiaries may be able to receive subsidies for Part D costs for premiums, deductibles, and co-pays. This is facilitated via the Part D Low Income Subsidy (“LIS” or “Extra Help”), which is administered by the Social Security Administration.

A Medicare Part D expert witness needs to thoroughly understand the differences between Part D eligibility and Medicaid eligibility and which populations each serves. Differences between Federal and State eligibility requirements are also crucial for a Medicare Part D expert witness to possess.

Medicare Appeals, Medicare Part C, and Medicare Part D Amounts in Controversy (AIC)

In general, the amount in controversy (AIC) is computed as the actual amount charged (or amount enrollee would have been charged) minus applicable deductible or coinsurance. For Medicare Part D, if the basis for the appeal is the refusal by the plan to provide drug benefits, AIC is determined by using the projected value of those benefits. Projected value includes any costs the enrollee could incur based on the number of refills prescribed for the disputed drugs during the plan year. For Part C, if the basis for the appeal is the MA plan’s refusal to provide services, the AIC is computed using the projected value of those services. For Parts C and D, appeals may be aggregated to meet the AIC. See §423.1970(c); [§405.1006(e) and (f)].

For more information, see the Medicare Parts C and Medicare Part D Enrollee Grievances, Organization/Coverage Determinations, and Appeals Guidance at https://www.cms.gov/Medicare/Appeals-and-Grievances/MMCAG/Downloads/Parts-C-and-D-Enrollee-Grievances-Organization-Coverage-Determinations-and-Appeals-Guidance.pdf

The latest release available at the time this article is published is dated February 2019.

In conclusion, finding a Medicare Part D expert witness involves several components to demonstrate Specialized Knowledge. Specialized knowledge is generally the Standard used by Courts to admit the testimony of an expert witness.

Related Posts

Pharmacy Benefit Manager (PBM) Expert Witness

Medicare Part C Medicare Advantage Risk Adjustment Expert Witness