PAID Act Plus SMART Act Requires NGHPs to Report or Pay Penalties

The Medicare, Medicaid and SCHIP Extension Act (MMSEA) of 2007 contains mandatory insurer reporting in Section 111 for “Non-Group Health Plans” or NGHPs. NGHPs liability insurance (including self-insurance governed by ERISA), no-fault insurance and workers’ compensation.

There is a new law passed by Congress on December 11, 2020, that goes into effect in late 2021. The Provide Accurate Information Directly (PAID) Act requires for the Centers for Medicare and Medicaid Services (CMS) provide additional data enabling Non-Group Health Plans (NGHPs) who are Responsible Reporting Entities (RREs) to search for Medicare beneficiary enrollment information using a single point of query to locate Medicare Part A, Medicare Part B as well as managed Medicare (called Medicare Advantage under Part C) as well as Prescription Drug (Part D) Plans for the prior 3 years.

MMSEA, PAID Act Enhancements Focused on Small NGHP Plans that use Direct Data Entry (DDE)

What many attorneys, industry analysts and policy wonks missed is that some of the most important enhancements as part of the PAID Act are meant to address “DDE Users.” which are typically small NGHPs who do direct data entry. To qualify for the DDE method, the RRE must be a Small Reporter which is defined as an RRE that intends to submit 500 or fewer claim reports per year. [i] Those NGHPs with higher volume already have an integrated portal that can be queried using the National Electronic Data Interchange Transaction Set Implementation Guide, Health Care Eligibility Benefit Inquiry and Response, ASC X12N 270/271 (004010X092A1). [ii]

New Data Available from CMS in MMSEA Section 111 Query

Effective December 11, 2021, the three-year span of Medicare Part A, Medicare Part B, Medicare Advantage and Medicare Part D Prescription Drug data will be provided in the NGHP Section 111 Query Response File. The data includes:

- Contract Number,

- Contract Name,

- Plan Benefit Package Number,

- Plan address,

- effective dates for the previous 3 years (up to 12 instances each for Part C and for Part D). This is consistent with the SMART Act provisions that set a three-year statute of limitations on a Medicare secondary payer claim by the Secretary for reimbursement against an applicable plan that becomes a Medicare primary payer pursuant to a settlement, judgment, award, or other judicial action.

MMSEA Eligibility Checking System Improvements

In compliance with the PAID Act, the HIPAA Eligibility Wrapper (HEW) application, has been updated to utilize new data in the NGHP X12 271 file format and convert it to a fixed-length S111 Query Response flat file. The HEW system works on both Windows and mainframe versions. It is important to note that the HEW has been in existence since 2009. These are merely updates to an existing CMS capability.

CMS issued new user guides on October 4, 2021:

- MMSEA 111 – October 4, 2021 – NGHP User Guide Version 6.5- Chapter I: Introduction and Overview (PDF) – no version updates

- MMSEA 111 – October 4, 2021 – NGHP User Guide Version 6.5- Chapter II: Registration Procedures (PDF) – updates to provide for implementation of PAID Act requirements

- MMSEA 111 – October 4, 2021 – NGHP User Guide Version 6.5- Chapter III: Policy Guidance (PDF) – Requirements around reporting when the CMS date of incident (DOI) is prior to December 5, 1980, have been clarified (Section 6.5.1).

- MMSEA 111 – October 4, 2021 – NGHP User Guide Version 6.5 – Chapter IV: Technical Information (PDF) – updates listed below have been made to the Technical Information Chapter Version 6.5 of the NGHP User Guide. Updates include:

- CMS now accepts records with MSP dates up to 3 months in the future; these records will no longer be held and submitted when the beneficiary’s eligibility comes into effect (Chapter 7).

- Because the TN30 error no longer causes input records to be rejected, descriptions of the TIN Reference Response File process have been updated (Section 6.3.3). [iii]

- To support the PAID Act, the beneficiary lookup function has been extended to DDE reporters (Chapter 3, Sections 8.5 and 10.5).

- To support the PAID Act, the Query Response File will be updated

- MMSEA 111 –October 4, 2021 – NGHP User Guide Version 6.5 – Chapter V: Appendices (PDF) – also updated to accommodate the PAID Act implementation

- MMSEA 111 – 270/271 Health Care Eligibility Benefit Inquiry and Response Companion Guide for Mandatory Reporting NGHP Entities, Version 5.7 (PDF) – updated August 6, 2021

Benefits from Strengthening Medicare and Repaying Taxpayers Act of 2012

H.R.1063 – The Strengthening Medicare and Repaying Taxpayers (SMART) Act made the penalties for failure to comply with Section 111 MMSEA which may include penalties of up to $1,000 per day for non-compliance. It also required that Medicare supply final conditional payment reimbursement information and clarify penalty provisions. The SMART Act also sets forth Safe Harbors including ‘good faith efforts’ to identify a beneficiary.

Related Posts

MMSEA Reporting Compliance Expert

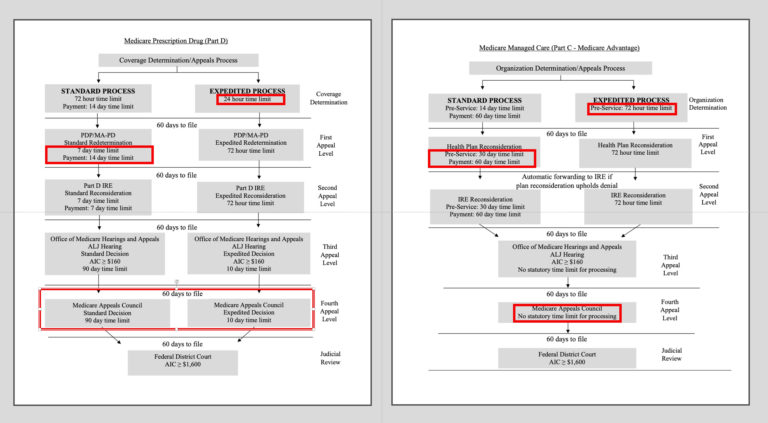

Medicare Advantage under Part C

Medical Billing Expert Witness

Medical Coding Expert Witness

Citations and Sources

[i] See CMS Training regarding Direct Data Entry for MMSE Section 111 liability insurance (including self-insurance), no fault insurance and worker’s compensation user guide.

[ii] See Medicare Coordination of Benefits (COB) System Interface Specifications 270/271 Health Care Eligibility Benefit Inquiry and Response HIPAA Guidelines for Electronic Transactions Companion Document for Mandatory Reporting Non-GHP Entities

[iii] In Prior User guides up to version 6.4 this documentation appeared: “A value of ‘TN’ in the TIN Disp Code (Field 22) Note: A TN30 error will be returned on the response file if Field 22 does not contain four numeric digits, all zeroes, or all spaces. However, the error no longer causes records to reject.”