Finding an ERISA Expert Witness

ERISA expert witness should understand the history of legislation that led to the regulations and the responsibilities of plan sponsors, administrative services only (ASO) and third-party administrator (TPA)

What is the History of ERISA?

ERISA was the culmination of a long line of legislation concerned with the labor and tax aspects of employee benefit plans.

History of regulations from 1921 to 1926 regarding employer tax deductions to fund pension funds

- Initially, the IRS was the primary regulator of private pension plans. The Revenue Acts of 1921 and 1926 allowed employers to deduct pension contributions from corporate income, and allowed for the income of the pension fund’s portfolio to accumulate tax free.

History of regulation in the 1950s – U.S. Department of Labor and the Welfare and Pension Plans Disclosure Act

- The U.S. Department of Labor became involved in the regulation of employee benefits plans upon passage of the Welfare and Pension Plans Disclosure Act in 1959 (WPPDA).

- Plan sponsors (e.g., employers and labor unions) were required to file plan descriptions and annual financial reports with the government; these materials were also available to plan participants and beneficiaries.

- This legislation was intended to provide employees with enough information regarding plans so that they could monitor their plans to prevent mismanagement and abuse of plan funds.

History of regulation in the 1960s – WPPDA oversight by the Secretary of Labor

- The WPPDA was amended in 1962, at which time the Secretary of Labor was given enforcement, interpretative, and investigatory powers over employee benefit plans to prevent mismanagement and abuse of plan funds.

- Compared to ERISA, the WPPDA had a very limited scope.

- Today, the goal of Title I of ERISA is to protect the interests of participants and their beneficiaries in employee benefit plans.

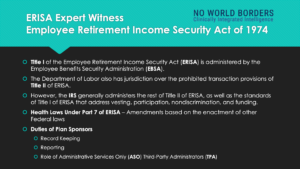

ERISA Plans are now regulated by the U.S. Department of Labor

- Within the U.S. Department of Labor (DOL), the Employee Benefits Security Administration (EBSA) is responsible for administering and enforcing the fiduciary, reporting and disclosure provisions of Title I of the Employee Retirement Income Security Act of 1974 (ERISA). See the EBSA Enforcement Manual here.

- EBSA was known as the Pension and Welfare Benefits Administration (PWBA) until February 2003

- PWBA was known as the Pension and Welfare Benefits Program before January 1986. At the same time, the Agency was upgraded to a sub-cabinet position with the establishment of Assistant Secretary and Deputy Assistant Secretary positions.

Importance of Employer Self Funded Health Plans Covering American Workers

What Are Requirements of Employers to Meet Responsibilities as Plan Sponsors?

ERISA Standards require that employers meet their responsibilities as plan sponsors. For example:

- ERISA sets standards of conduct for those who manage employee benefit plans and their assets called fiduciaries.

- An ERISA covered group health plan is an employment-based plan that provides medical care coverage, including hospitalization, sickness, prescription drugs, vision, or dental.

- It can provide benefits by using funds in a plan trust, purchasing insurance, or self-funding benefits from the employer’s general assets.

- Employers often hire outside professionals (sometimes called third-party service providers) or use an internal administrative committee or human resources department to manage some or all of a plan’s day-to-day operations.

- Administrative services only (ASO) is an arrangement in which a company funds its employee benefit plan, such as a health insurance program, while purchasing only administrative services from the insurer. This alternative funding option is a group health self-insurance program often used by large employers who assume responsibility for all the risk, remaining exclusively liable for all financial and legal elements of the group benefits plan.

- The material below provides an overview of the essential fiduciary responsibilities that apply to group health plans under the law.[2]

What Are Essential Elements of ERISA Self-Funded Plans?

Each employer-sponsored ERISA plan has elements including:

- There must be a written plan describing benefit structure guides day-to-day operation;

- ERISA requires that trust is established to hold the plan assets;[3]

- There must be a system established to track contributions and benefit payments,

- The system must track and maintain participant and beneficiary information and accurately prepare reporting documents;

- Plan sponsors must provide documented plan information to participating employees and the U.S. Department of Labor.

Employers often hire outside professionals (sometimes called third-party service providers) or use an internal administrative committee or human resources department to manage some or all of a plan’s day-to-day operations. There may be one or several officials with discretion over the plan. These are the plan’s fiduciaries. [4]

Who Is an ERISA Plan Fiduciary?

The actions involved in operating a plan make the person or entity performing them a fiduciary. A person using discretion in administering and managing a plan or controlling the plan’s assets is a fiduciary to the extent of that discretion or control. Thus, fiduciary status is based on the functions performed for the plan, not just a person’s title. [5]

ERISA Expert Witness Should Understand Administrative Services Only (ASO)

An “ASO,” which means ‘Administrative services only’ is established to enable an employer / Plan Sponsor to fund its employee benefit plan, such as health insurance, while purchasing only administrative services from an insurer. For example, a large employer may establish an ASO with a known health plan such as Blue Cross or Cigna, who not only provides insurance to individuals but uses the infrastructure, policies, and procedures, and technology to provide ASO services to an employer. This alternative funding option is a group health self-insurance program that may be used by large employers who opt to assume responsibility for all the risk, remaining exclusively liable for all financial and legal elements of the group benefits plan.[6]

ERISA Expert Should Understand Typical Administrative Services of an ASO

An ERISA Expert witness should understand several key points. First, when an employer contracts with an ASO, specific administrative services from a third-party administrator (TPA) are carried out by the TPA. Some of the services offered in an ASO may include:

- Receiving and responding to communication with insured employees of a Plan Sponsor

- Sending communication to insured employees regarding updates, changes, and policy documents

- Internal audits of controls to ensure the accuracy of accounting.

- Performing the accounting required by the U.S. DOL as well as the reporting functions

- Making Determinations of benefits after conferring with the Plan Sponsor regarding actuarial costs and considerations, the ERISA requirements, and those of the Affordable Care Act, including Essential Health Benefits (EHB).[7]

- Facilitating standard transactions such as prior authorizations[8], adjudicating the claims, including receiving and evaluating claims to ensure that they meet the conditions of coverage including medical necessity,[9] which may include utilization management[10], as well as paying, pending, or denying claims based on the clinical and medical coverage determinations of the plan.

- Developing a plan for administering benefits enrollment and executing the benefits enrollment functions

- Managing Continuation of Health Coverage (COBRA), [11] Health Reimbursement Arrangements (HRAs) for small employers,[12] Health Savings Account (HSA), [13] FSA, and the like.

- Preparing an administration manual and summary plan descriptions.

- Complying with health care claim electronic Standards such as HIPAA 5010 and ICD-10 and the HIPAA transactions as defined by ANSI X12 as provided for in the Federal Register.[14]

- Determine provider networks for beneficiaries

An ASO arrangement may be offered for short-term disability,[15] extended health, and dental care benefits, and sometimes long-term disability benefits (see worker’s compensation as this also provides benefits).[16] Employers rarely provide life insurance under an ASO system because of the large coverage amounts.[17]

Stop Loss Protections and ASO Arrangement

ERISA expert witnesses should possess a good knowledge of actuarial and risk pool assumptions. So-called risk corridors are used to stratify the population of employees that are being insured by a Plan Sponsor and the amount of care or ‘utilization’ of a plan. To protect themselves from the financial liability of outlier cases of insureds with many expensive comorbidities, employers purchase stop-loss insurance. This protects against catastrophic losses should their employees’ insurance needs because of severe illness or injury. [18]

Stop-loss insurance is secured by paying premiums to the insurer in which claims that exceed the stop-loss level (often set at $10,000 per insured employee) become the responsibility of the insurer. Aggregate stop-loss thresholds are usually considered by the employer when selecting stop-loss insurance. [19] Self-funded insurance may also be used to cover expenses such as high-cost prescription drugs.

ERISA Expert Witness Knowledge of ASO Contracts with Third-Party Administrators (TPAs)

An ERISA expert witness should be articulate regarding ASO contractual relationships. These relationships enable an employer to outsource the administration of a health plan by paying a fee to a third-party administrator (TPA) to manage claims processing, organize provider networks, and manage other health plan logistics. These tasks in the hands of someone outside your company also eliminate the need for you to hire a dedicated group health insurance employee and eliminate the need to pay another full salary and benefits.

Companies may have greater ability to make determinations of their group health insurance benefits work under an ASO plan because the employer controls their cash flow and only pays for claims when incurred. However, these assumptions are subject to certain actuarial assumptions, compliance with Federal Standards such as ERISA and the Affordable Care Act, risk pools, and stop-loss insurance.

ERISA Fully Funded Plans and Out of Network Charges

Health Laws Under Part 7 of ERISA

Federal health laws enacted since 1974 have amended ERISA. The following is a summary:

- There is a proposed amendment published September 2021 regarding “…proposed exemptions from certain of the prohibited transaction restrictions of the Employee Retirement Income Security Act of 1974 (ERISA or the Act) and/or the Internal Revenue Code of 1986 (the Code). If granted, these proposed exemptions allow designated parties to engage in transactions that would otherwise be prohibited provided the conditions stated therein are met. This notice includes the following proposed exemptions: L-12008, Phillips 66 Company; L-12021, Comcast Corporation…”

- The Patient Protection and Affordable Care Act (the Affordable Care Act or ACA). The Affordable Care Act amended ERISA to incorporate several health coverage market reforms.

- Health Insurance Portability and Accountability Act of 1996. The Health Insurance Portability and Accountability Act of 1996 (HIPAA) amended ERISA to provide for improved portability and continuity of health coverage

- The Newborns’ and Mothers’ Health Protection Act of 1996 (Newborns’ Act) requires plans that offer maternity coverage to pay for at least a 48-hour hospital stay in connection with childbirth (a 96-hour stay in connection with a cesarean section).

- The Women’s Health and Cancer Rights Act (WHCRA) contains protection for patients who elect breast reconstruction in connection with a mastectomy. For plan participants and beneficiaries receiving benefits in connection with a mastectomy, plans offering coverage for a mastectomy must also cover reconstructive surgery and other benefits related to a mastectomy.

- The Mental Health Parity Act of 1996 (MHPA) provides for parity in the application of aggregate lifetime and annual dollar limits on mental health benefits with dollar limits on medical/surgical benefits.

- The Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA) expanded the protections of MHPA to financial requirements (e.g., copayments or deductibles)and treatment limitations (e.g., visit limits).

- The Genetic Information Nondiscrimination Act of 2008 (GINA) prohibits group health plans and group health insurance issuers from discriminating in health coverage based on genetic information.

- Michelle’s Law, passed in 2008, prohibits group health plans from terminating coverage for a dependent child who has lost student status as a result of a medically necessary leave of absence.

- The Children’s Health Insurance Program Reauthorization Act of 2009 (CHIPRA) requires group health plans and group health insurance issuers to permit an employee or dependent that is eligible for but not enrolled in the plan to enroll when the employee or dependent is covered under Medicaid or CHIP and loses that coverage as a result of loss of eligibility or when the employee or dependent becomes eligible for Medicaid or CHIP assistance with respect to coverage under the group health plan.

ERISA Expert Witness Article Citations

[1] See Kaiser Family Foundation Employer Health Benefits Survey for 2019

[2] U.S. Department of Labor “Understanding Your Fiduciary Responsibilities Under a Group Health Plan” See https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/publications/understanding-your-fiduciary-responsibilities-under-a-group-health-plan.pdf

[3] According to the U.S. Department of Labor, “If a plan is set up through an insurance contract, then the contract does not need to be held in trust. If a plan is self-funded (paid from the employer’s general assets), those funds are not planned assets except for any participant contributions withheld or received.?

[4] U.S. Department of Labor “Understanding Your Fiduciary Responsibilities Under a Group Health Plan” See https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/publications/understanding-your-fiduciary-responsibilities-under-a-group-health-plan.pdf

[5] U.S. Department of Labor “Understanding Your Fiduciary Responsibilities Under a Group Health Plan” See https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/publications/understanding-your-fiduciary-responsibilities-under-a-group-health-plan.pdf

[6] The Benefits Group https://healthbrokers.com/ancillary/aso/

[7] According to the U.S. Healthcare.gov: A set of 10 categories of services health insurance plans must cover under the Affordable Care Act. These include doctors’ services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, and more. Some plans cover more services.

[8] Americas Health Insurance Plans (AHIP). Medical Management and Prior Authorizations.

[9] It has been noted that 65% of physicians reporting a survey said that that at least 15-30% of care is unnecessary. See Overtreatment in the United States. Lyu H, et al. PLOS One. Sept. 6, 2017

[10] Utilization management, also known as medical management, is used by health plans to protect. patient safety; prevent unnecessary, inappropriate, and potentially harmful care; improve and. better coordinate care; and increase health care affordability

[11] According to the U.S. Department of Labor, “The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, the transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102% of the cost to the plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

COBRA outlines how employees and family members may elect continuation coverage. It also requires employers and plans to provide notice.” https://www.dol.gov/general/topic/health-plans/cobra

[12] According to U.S. Healthcare.gov: “Certain small employers—generally those with less than 50 employees that don’t offer a group health plan—can contribute to their employees’ health care costs through a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA). A QSEHRA allows small employers to provide non-taxed reimbursement of certain health care expenses, like health insurance premiums and coinsurance, to employees who maintain minimum essential coverage, including an individual Marketplace plan. In many states, QSEHRAs allow small employers to provide their employees additional plan choices without managing group health plan coverage.” ERISA experts should be articulate on this issue.

[13] According to the U.S. Healthcare.gov: A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in a Health Savings Account (HSA) to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs. HSA funds generally may not be used to pay premiums.

[14] See Federal Register, Health Insurance Reform: Standards for Electronic Transactions, a Rule by U.S. Department of Health and Human Services published August 17, 2000, and effective October 16, 2000. 45 CFR 160; 45 CFR 162

[15] Generally, ERISA covers any plan, fund, or program that provides sickness, accident, or disability benefits. This would include all short-term disability (STD) programs but for an exception that has been made regarding payroll practices. To determine whether a plan fits within this safe harbor exception, the label and intent of the employer are not controlling. Instead, an employer must answer these 4 questions about their STD programs:

Who is getting paid? If an STD program provides payments to individuals other than employees, then the program will not fit within the payroll safe harbor and ERISA will govern. Payments must be made to individuals that retain their employee status while absent from work. If an STD program includes payments to former employees, such as those permanently disabled or those that were terminated, then the program will not qualify for safe harbor. It is crucial that employers address what effect termination of employment will have on the STD benefits they receive.

How much are the payments? A program that pays an employee more than their normal compensation will not fit within the safe harbor. To be considered a payroll practice, payments must be equal to or less than normal compensation. Most employers’ STD programs pay less than normal compensation, so this factor is rarely an issue.

What source is the payment coming from? Payments must be paid out of an employer’s general assets. An STD program that sources payments to employees from either insurance or a separately funded program will fail to fit within the safe harbor.

Why are the payments being made? To fit within the safe harbor, the Department of Labor made this safe harbor exception for the payments that are made when “the employee is either physically or mentally unable to perform work related duties or is otherwise absent for medical reasons.” Examples include absence due to maternity leave, physical examination, or psychiatric treatment.

[16] Workers’ compensation provides benefits to employees in exchange for limiting liability to the employer.

[17] According to Investopedia, “In some cases, an ASO arrangement may not be suitable for life insurance and extended healthcare benefits. Employers need to weigh the risks and benefits of how different ASO arrangements might affect their organizations.”

[18] According to Kaiser Family Foundation: “Many firms, particularly larger firms, choose to pay for some or all of the health services of their workers directly from their own funds rather than by purchasing health insurance for them. This is called self-funding. Both public and private employers use self-funding to provide health benefits. Federal law (the Employee Retirement Income Security Act of 1974, or ERISA) exempts self-funded plans established by private employers (but not public employers) from most state insurance laws, including reserve requirements, mandated benefits, premium taxes, and many consumer protection regulations. Sixty-one percent of covered workers are in a self-funded health plan in 2019. Self-funding is common among larger firms because they can spread the risk of costly claims over a large number of workers and dependents.” An ERISA expert witness should understand these fundamental concepts.

[19] “The threshold is calculated based on a certain percentage of projected costs (called attachment points)—usually 125% of anticipated claims for the year. An aggregate stop-loss threshold is usually variable and not fixed. This is because the threshold” fluctuates as a percentage of an employer’s enrolled employees.”

Related Posts

Medicare Local Coverage Determination