ICD-10 Financial Risk Assessment Complete Solution and Approach

ICD-10 Financial Risk Assessment Selected list of activities and deliverables

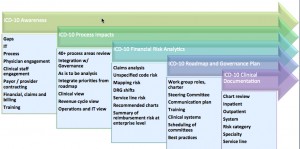

- A complete assessment of ICD-10 impacts to process, financial, operations, and systems

- Assessment of over 40 processes (customized for your organization)

- DRG shift risk, ICD-10 reimbursement mapping risk, unspecified codes risk, high volume, high dollar risk.

- Case Mix Index, and procedure code reimbursement variations from twelve to twenty four months of claims data

- Complete AHIMA and AAPC Certified professional chart review

- Physician engagement and training

- Business roadmaps and organizational change management.

- In-depth predictive analysis to help accelerate training efforts and identify gaps in documentation

- Double coding of claims in ICD-9 and ICD-10 and a thorough testing approach for payor / provider and vendor issues

- Examination of healthcare IT release dates for all impacted systems

- Ability to deliver crosswalks, automated system scans for ICD impacts

- Project management tools including detailed reports and project dashboards

- In-depth understanding of Medicare, Medicaid, Regulatory issues

- On-site observation of clinical documentation, CPOE (where applicable), physician documentation practices and education about the denial risks of unspecified codes, lack of specificity for laterality and new ICD-10 based terminology

- Explanation of the role of the coder in supporting the clinician for ICD-10

Upon conclusion of the ICD-10 Financial Risk Assessment work you will know:

- What the timing and resources need to be to accomplish the transition

- A clear picture of your financial risk and upside from moving to ICD-10 in terms of coding and clinical documentation

- What steps you need to take to minimize risk and maximize opportunity

- Gaps in your systems, IT, processes and people (organizational readiness and ICD-10 CMMI maturity model)

- Your governance plan, mission, team composition etc.

- How you need to engage with your clinical staff, HIM, training, financial, billing, and other functional areas

- What the trade offs are on cross walking and coding in ICD-9 and ICD-10 for testing and claims production

- Testing arrangements and timing with CMS / Medicare / State Medicaid.

No World Borders ICD-10 Financial Risk Analysis Report

We prepare a report of ICD-10 unspecified coding risks, down to the attending physician level. Reports and analysis are developed for both inpatient and outpatient ICD-10 Financial Risk analysis as needed. DRG related shifts and resulting reimbursement risk. The diagnosis-related groupings (DRGs) shift can change because of code sequencing issues in principal diagnosis, secondary diagnosis, mapping risk or because of expected lower tolerances by CMS and private insurers for unspecified and unrelated code and DRG descriptions. This helps create actionable insights regarding where to remediate clinical documentation to improve documentation of medical necessity to help reduce ICD-10 claims denials.

No World Borders ICD-10 Financial Risk Analysis

There is no substitute for the clinical view and experience combined with the right technology and analytics. We provide comprehensive reports and actionable consulting approaches to help you use:

- Claims analysis for ICD-10 Financial Risk reimbursement risk perspective

- We provide AHIMA and AAPC Certified Chart Reviews and Chart Audits with complete reports

- Physician engagement and education as well as experienced physician consultants who have the credibility to help bridge the gap from operational, IT, coding and clinical perspectives to actually affect changes.

- The right approach, strategy and skills to begin ICD-9 and ICD-10 double coding and test plan development.

Related Posts

- ICD-10 Financial Risk Assessment and and ICD-10 Crosswalk Using ICD-10 Predictive Analytics

- ICD-10 Financial Risk Assessment and Data Quality – Why You Need it and How to Get Started

- ICD-10 Financial Risk Assessment by Service Line

- ICD-10 Financial Risk Assessment, Case Management, RAC Audits, Dual Eligibles

- ICD-10 Financial Risk Assessment, Process Risk – ICD-10 diagnosis and ICD-10 procedure codes, provider patient scheduling workflow