[fusion_builder_container hundred_percent=”yes” overflow=”visible”][fusion_builder_row][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”]

Inefficiencies in Claim Reimbursement

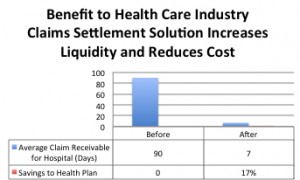

One overlooked area is the length of time required for health care providers who are out of the network to get reimbursed. Average reimbursement time for such claims can be 90 days, with most falling within 58 to 120 days.

Recession and Regulations Will Increase Demand for Claims Settlement and Cost Containment Solutions

During the recession, solutions have focused more on cost take out rather than increasing the top line revenue with companies. Out of network claims settlement solutions have gained traction as a way to assist in lowering the cost of healthcare while increasing speed of reimbursement. In general, immediate cash is more important now than ever for health care providers who operate on thin margins with long receivables for claims.

New regulations such as HIPAA ICD-10 and HIPAA 5010 tend to at least temporarily slow claims adjudication and reimbursement, further increasing the demand for solutions that address these issues.

Affordable Care Act Mandates Compliance to Medical Loss Ratio

The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement, also known as the Medical Loss Ratio (MLR). Unfortunately, most of the vendors providing these solutions charge the health plan a fee for this service which must be considered an administrative expense rather than a medical expense. This creates another problem for health plans who are required to adhere to Medical Loss Ratio (MLR) rules. By these rules, a health plan must pay out eighty five percent (85%) of the member premiums paid in. In other words, health plans can only take 15% of their revenues off the top for operating, IT expense, wages, etc. If health plans fall below 85% MLR they must pay rebates to their members.

Since most of the cost containment and settlement solutions vendors do charge the plan, this actually works against the health plan’s ability to manage their expenses and comply with regulations.

Best Practice Strategy

Health plans should look to solutions that support the MLR calculation and regulations, and maximize the speed and the amount of reimbursement to the provider. Claims settlement solutions that support these regulations do not charge the health plan for their services.

Health care providers should seek to maximize the speed of reimbursement, while limiting the discounts to accelerate cash flow.

Our firm can recommend a solution that achieves both goals.

[/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]